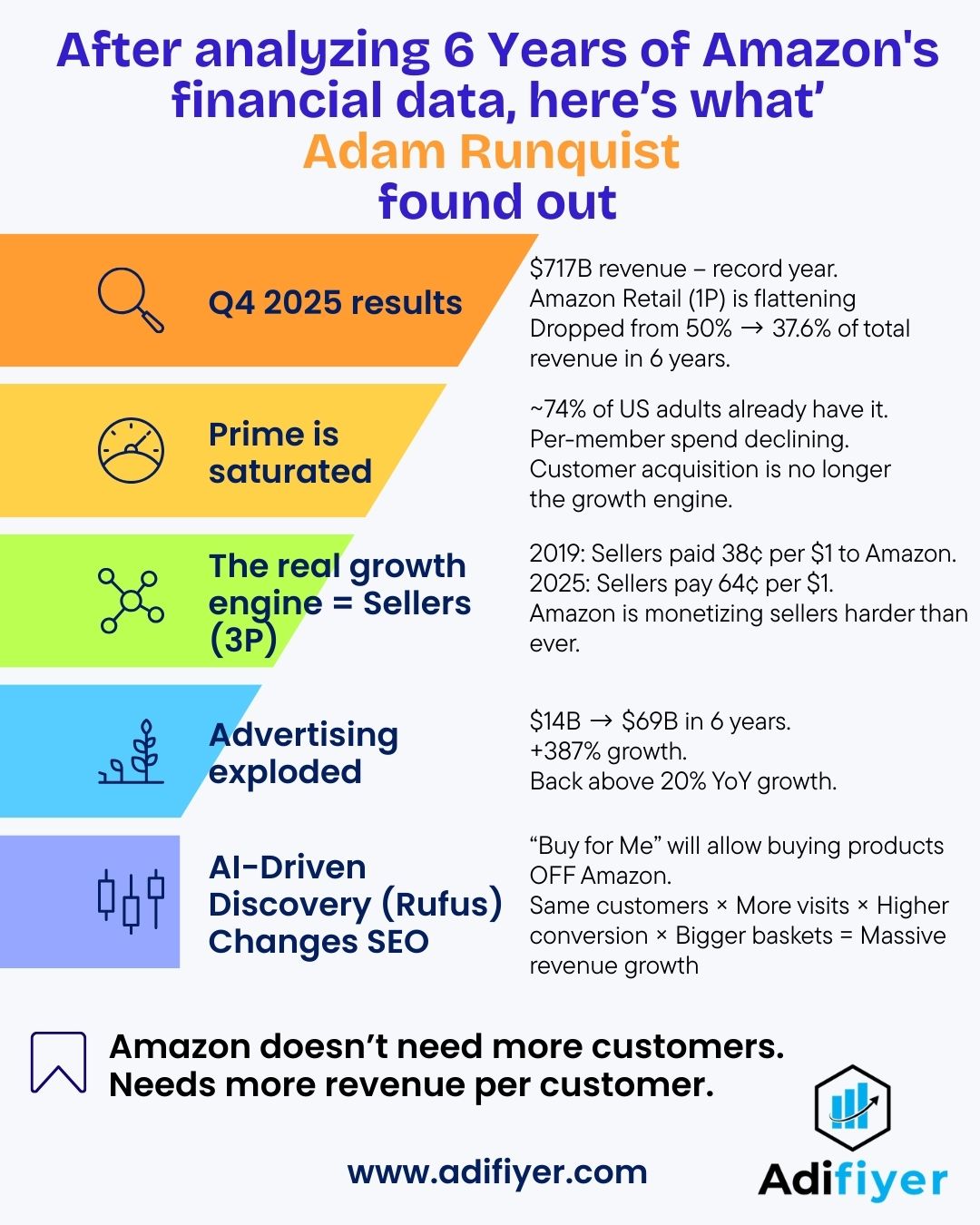

Amazon’s $717B Year: What Sellers Must Understand About the Next Phase of Growth

Amazon just posted a record-breaking $717B in revenue.

At first glance, it looks like unstoppable growth.

But when you dig into the numbers, a different story emerges. Amazon is entering a new phase. A maturity phase.

And this phase changes everything for sellers.

After analyzing six years of financial trends and the Q4 2025 results, one thing is clear:

Amazon no longer needs more customers.

It needs more revenue per customer.

Let’s break down what that means.

Prime Is Saturated

Prime was once Amazon’s growth rocket.

Now?

• ~74% of US adults already have Prime

• Growth slowed from ~35% annually to ~6%

• Per-member spend is declining

The customer base is largely set.

Amazon cannot rely on adding millions of new Prime members each year to fuel expansion. That era is over.

Amazon’s Own Retail Business Is Flattening

Amazon’s first-party retail (its own products) used to dominate revenue.

Six years ago:

• Amazon retail accounted for 50% of total revenue.

Today:

• It accounts for 37.6%.

While 2025 saw a 9% growth rebound, its share of total revenue continues to decline.

So if Prime is maturing and retail is flattening…

Where is the growth coming from?

The Real Growth Engine: Third-Party Sellers

Third-party sellers are now the backbone of Amazon’s expansion.

Here’s the critical shift:

• 2019: Sellers paid 38¢ of every $1 back to Amazon

• 2025: Sellers pay 64¢ of every $1

That is a massive structural change.

Amazon’s revenue growth is increasingly tied to seller fees, advertising, fulfillment, and services.

In simple terms:

Amazon grows when sellers spend more.

Advertising: The Silent Giant

Advertising revenue exploded:

• $14B → $69B in 6 years

• +387% growth

• No down years

• Back above 20% growth in 2025

This is not experimental revenue anymore.

Advertising is now foundational to Amazon’s business model.

PPC is no longer optional.

It is structural.

Enter Rufus: Amazon’s AI Monetization Engine

The next phase of growth has a name: Rufus.

Rufus is Amazon’s AI shopping assistant, and it already has:

• 300M+ users (up from 270M in Q3)

• ~$12B in incremental annualized sales

And here’s the key:

This growth is coming from the same ~200M Prime customers.

No new customers required.

Rufus is designed to:

• Increase visits per customer (targeting 150 → 350 visits per year)

• Increase basket size (2.3 items/order → 4–6 items)

• Improve conversion rates

• Insert advertising into AI conversations

• Expand ad inventory inside Prime Video (315M+ MAUs)

The formula is powerful:

Same customers × more visits × higher conversion × bigger baskets = exponential revenue.

This is revenue multiplication, not customer expansion.

Other Strategic Signals

There are additional indicators of Amazon’s direction:

• “Buy for Me” will allow shoppers to purchase products off Amazon

• 70% more same-day delivery items

• AI-powered ad and creative tools highlighted for sellers

Amazon is investing in:

- Speed

- AI

- Advertising inventory

- Basket expansion

Everything points toward maximizing revenue per active user.

What This Means for Sellers

This is where strategy changes.

1. PPC Is Structural, Not Tactical

Amazon’s growth depends on ad revenue.

That means:

• Ad competition will increase

• CPC pressure will continue

• Creative differentiation will matter more

The sellers who treat PPC as optional will lose visibility fast.

2. ACOS Obsession Is Dangerous

When Amazon’s goal is basket expansion and higher GMV, sellers must think differently.

Instead of asking:

“How do I lower ACOS?”

Ask:

“How do I grow profitably while increasing total revenue?”

Focus on:

• TACOS

• Contribution margin

• LTV

• Repeat purchase rates

Profit modeling becomes more important than keyword-level optimizations.

3. Bundling and Cross-Sell Will Win

If Amazon wants:

2.3 items per order → 4–6 items per order

Then sellers must align.

Opportunities include:

• Virtual bundles

• Complementary product targeting

• Sponsored Display cross-sell

• Store redesign for upsells

• Subscribe & Save optimization

Basket expansion is the new battlefield.

4. AI Will Reshape Listing Optimization

With AI-assisted shopping like Rufus:

• Listings must be clearer and more structured

• Benefits must be explicit

• Use-case clarity matters

• A+ content must guide decision-making

AI does not “guess” emotional positioning well. It responds to clarity and relevance.

SEO is no longer just keyword stuffing.

It’s structured persuasion.

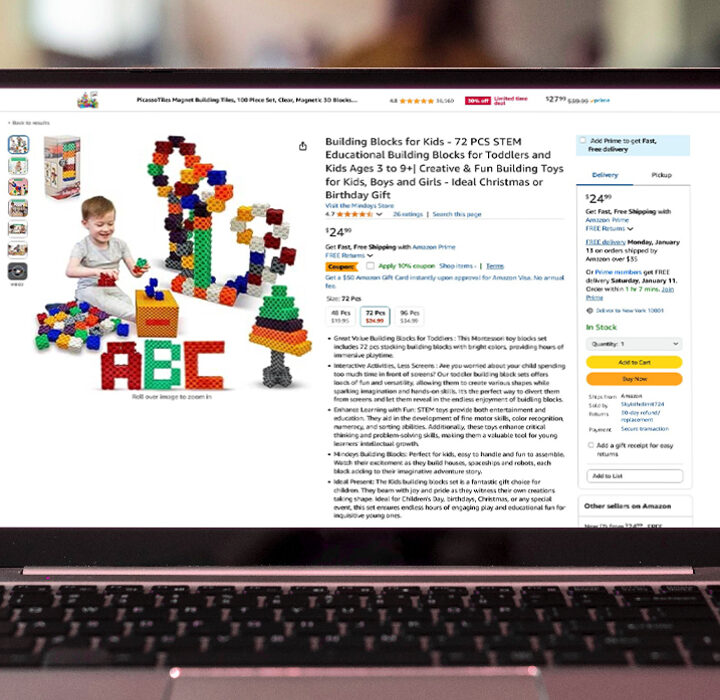

5. Creative Becomes a Growth Lever

Amazon explicitly mentioned ads and creative AI agents as tools for sellers.

That means:

• Image quality impacts conversion more than ever

• Video ads will scale

• UGC content will dominate

• Creative testing will accelerate

Creative is no longer branding fluff.

It is performance infrastructure.

6. Speed = Conversion

With 70% more same-day eligible items:

• Inventory planning becomes critical

• Geographic stock strategy matters

• High-velocity SKUs gain algorithmic advantage

Fast shipping increases conversion, which increases revenue, which feeds the system.

The Bigger Picture

Amazon’s growth is entering a monetization phase.

It is no longer about:

More customers.

It is about:

More value per customer.

And the burden of that growth will largely fall on sellers.

The sellers who understand this structural shift will:

• Invest in creative

• Master full-funnel advertising

• Build bundles and cross-sell ecosystems

• Optimize for profit, not vanity metrics

• Adapt to AI-driven discovery

The rest will unintentionally fund Amazon’s next record year.

Final Thought

Amazon’s $717B year isn’t just a milestone.

It’s a signal.

The platform is maturing. The rules are evolving.

The next winners will not be the cheapest bidders.

They will be the most strategic operators.

If you’re a seller or service provider, now is the time to adjust your model.

Because the math has changed.