Amazon’s Marketplace Evolution: Strategy, Ads, and AI for 2026

Amazon’s Q4 2025 Reality: What Sellers Must Understand Now

Amazon just reported one of its biggest years ever.

Q4 2025 revenue crossed $213 billion.

Full-year revenue reached approximately $717 billion.

On the surface, that sounds like unstoppable growth.

But when you look deeper, the real story isn’t about how big Amazon is.

It’s about how Amazon plans to grow next.

And that growth strategy directly impacts sellers.

This is not a Wall Street breakdown.

This is a seller-focused breakdown of what’s actually happening inside Amazon’s ecosystem.

1. Amazon Is Still Growing — But Differently

Yes, revenue is up.

But growth today is very different from the pandemic surge years.

Instead of explosive customer acquisition, Amazon’s current growth is coming from:

• Advertising

• Third-party seller services

• Logistics efficiency

• AI-driven shopping behavior

• AWS profitability

That shift changes the marketplace dynamics.

2. Prime Is Saturated

Prime penetration in the United States is estimated at around 74% of adults.

That means nearly everyone who wants Prime already has it.

Prime membership growth has slowed from previous double-digit or even 30%+ growth years down to single-digit expansion.

What does this mean?

Amazon can no longer rely on millions of new Prime subscribers every year to fuel revenue growth.

So instead of growing by adding new customers, Amazon must grow by:

• Increasing how often customers shop

• Increasing how much they buy per visit

• Increasing ad exposure

• Increasing revenue per order

The strategy has shifted from expansion to monetization.

3. Amazon Retail Is No Longer the Center

Six years ago, Amazon’s own retail business (first-party products) represented about half of total revenue.

Today, that percentage has fallen significantly.

Amazon still sells its own products, but the share of revenue coming from third-party sellers has steadily increased.

Why?

Because the marketplace model is more profitable.

Amazon:

• Avoids inventory risk

• Collects referral fees

• Charges fulfillment fees

• Sells advertising

• Monetizes logistics

In short, sellers carry the product risk.

Amazon collects the infrastructure revenue.

4. The Seller Contribution Has Increased Dramatically

Let’s simplify this with a clear example.

In 2019:

Sellers paid roughly 38¢ of every $1 earned back to Amazon through fees and services.

In 2025:

Sellers now pay roughly 64¢ of every $1 earned back to Amazon.

Think about that.

If you sold $100 in 2019, Amazon might have kept $38.

If you sell $100 today, Amazon may keep $64 through:

• Referral fees

• FBA fees

• Storage fees

• Advertising spend

• Returns and service costs

That’s a massive structural change.

Amazon’s revenue growth increasingly depends on seller monetization.

This is not accidental.

It is strategic.

5. Advertising Is Now Core Infrastructure

Amazon’s advertising revenue has grown massively over the past six years.

From roughly $14 billion annually to nearly $70 billion.

That is nearly a 5x increase.

Advertising is no longer a side business.

It is a primary revenue engine.

What does that mean for sellers?

Organic visibility alone is no longer enough.

Sponsored placements dominate search results.

Product detail pages are filled with ads.

AI-driven discovery creates new ad placements.

If you are not advertising strategically, you are invisible.

PPC is no longer optional.

It is structural.

6. Rufus: Amazon’s AI Shopping Assistant

One of the most important developments in 2025 is Amazon’s AI assistant, Rufus.

Rufus is now used by over 300 million customers and has reportedly driven billions in incremental sales.

Here’s what that means in practical terms.

If a customer types:

“I need hiking boots for winter trails.”

Rufus doesn’t just show boots.

It suggests:

• Hiking boots

• Wool socks

• Waterproof spray

• Thermal insoles

• Trekking poles

That transforms a single-item purchase into a multi-item basket.

Amazon’s goal is simple:

Increase visits per customer.

Increase items per order.

Increase conversion rate.

Increase ad impressions.

All without adding new customers.

The formula becomes:

Same customers × more visits × bigger baskets × more ads = higher revenue.

This is revenue multiplication, not customer expansion.

7. Same-Day and Fast Delivery Is a Conversion Weapon

In 2025, Amazon massively expanded same-day and next-day delivery coverage.

Billions of items were delivered same or next day.

Fast delivery does something powerful:

It increases conversion rates.

It also increases basket size.

For example:

A customer ordering groceries or household items with same-day shipping often adds extra items because the purchase feels immediate and convenient.

Fast shipping reduces hesitation.

And lower hesitation increases order size.

Sellers who qualify for fast fulfillment gain a competitive edge.

8. What This Means for Sellers

Now let’s translate all this into practical reality.

PPC Must Be Strategic

Because Amazon’s growth depends on advertising revenue:

• Competition will increase

• CPC pressure will remain

• Sponsored placements will dominate

Instead of obsessing over the lowest ACOS, sellers must focus on:

• TACOS

• Contribution margin

• Total revenue growth

• Long-term profitability

Bundling and Cross-Sell Matter More Than Ever

If Amazon wants customers to go from 2.3 items per order to 4–6 items per order, sellers should align with that strategy.

Examples:

• Sell a yoga kit instead of just a yoga mat

• Bundle phone + case + screen protector

• Offer multi-packs

• Target complementary ASINs

Basket expansion increases:

• Revenue per order

• Ad efficiency

• Profit potential

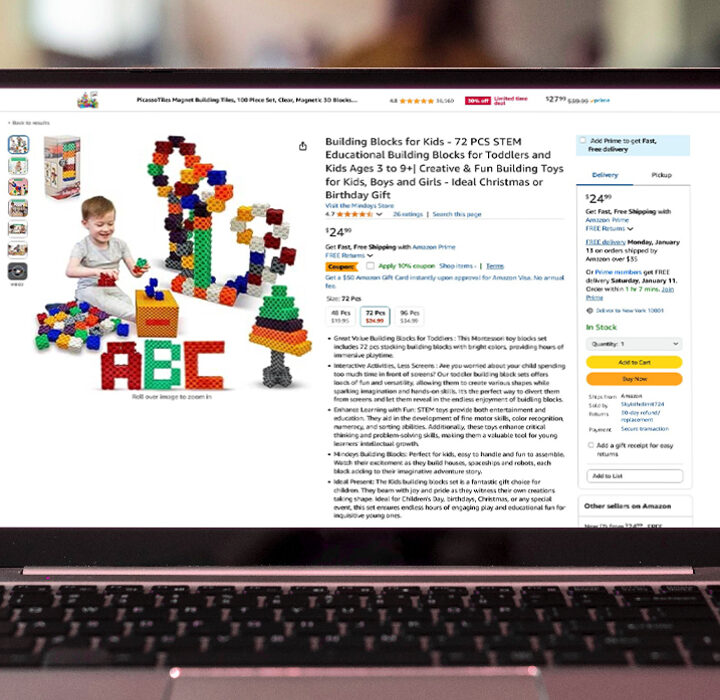

Listings Must Be AI-Friendly

With AI assistants influencing purchase decisions:

• Titles must be clear

• Bullets must explain benefits simply

• Images must communicate instantly

• A+ content must remove objections

AI does not respond well to vague marketing language.

Clarity converts.

Creative Is Now Performance Infrastructure

Amazon is integrating AI creative tools and expanding ad placements.

That means:

• Better images increase conversion

• Better video increases engagement

• Better creatives improve ad performance

Creative is no longer branding fluff.

It directly impacts profitability.

The Bigger Picture

Amazon’s Q4 2025 results show a clear pattern.

Growth is shifting from customer expansion to customer monetization.

From retail dominance to marketplace dominance.

From organic discovery to paid and AI-assisted discovery.

From simple transactions to larger baskets.

Sellers who understand this shift will:

• Build bundles

• Optimize full-funnel advertising

• Focus on profit modeling

• Improve creative assets

• Leverage fast fulfillment

Sellers who don’t adapt will struggle with rising costs and shrinking margins.

Final Thought

Amazon’s $717 billion year is impressive.

But the real story is not the size.

It’s the strategy.

Amazon doesn’t need more customers.

It needs more value per customer.

And that value increasingly comes from sellers.

The question isn’t whether Amazon will grow.

The question is whether sellers will grow profitably with it.